capital gains tax changes proposed

President Bidens plan has also proposed making the tax changes retroactive to April 2021. Already mentioned above this proposed change would almost double the current rate on long-term capital gains which is at 20.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

. Proposed Changes to Capital Gains Tax. The changes in capital gains taxes will also affect the real estate and housing industry. Backers of a proposed capital gains tax that would provide lawyers to tenants facing eviction are mounting a signature gathering effort in hopes of getting the initiative on the November ballot.

Today well touch on changes regarding taxes people pay on revenue income and capital gains taxes. 13 2021 if passed. Under the changes proposed by the American Families Plan capital gains could be taxed at the same rate as ordinary income.

The plan would not only tax unrealized capital gains upon death but raise the capital-gains rate from 238 to 434. The proposed increase in capital gains tax would raise the tax from 20 percent to the highest of 396 percent affecting the wealthiest taxpayers on gains realized after Sept. Capital Gains Tax CGT is very broadly a tax on the difference between an assets value when acquired and its value at disposal less any allowable expenses.

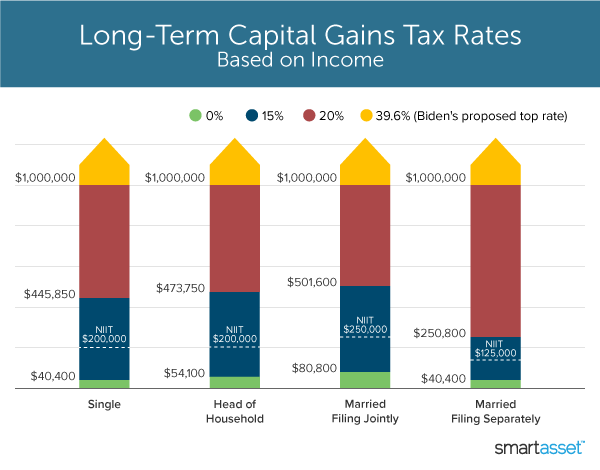

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The proposed top marginal tax rate of 396 combined with the 38 NIIT would result in a top capital gains tax rate of 434. The proposed tax law changes would disallow the use of section 1031 for capital gains over 500000.

An increase in Capital Gains Tax while seen as a logical or overdue step by some has caused uproar among many tax observers and business owners. Increase in Capital Gains Rate. Twenty-six states and the District of Columbia had notable tax changes take effect on January 1 2021.

These higher taxes. Limits on the Step-Up. But because the higher tax rate as proposed would only.

Although it is possible changes will. Youll owe either 0 15 or 20. Currently depending on the nature of the real estate.

Long-Term Capital Gains Taxes. The individual tax rate could just from 37 to 396 for those making more than 400000 annually. For a fund that issues only ETF units the new rule in proposed paragraph 132531a generally denies the fund a deduction in computing its income for a taxation year to the extent that the total allocated amounts paid out of the ETFs net taxable capital gains exceed a portion of those gains as determined by a formula.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories. As a business seller if you are in either the low or mid earning. These are the current rules but the Biden administration has proposed some changes.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. The increased rate would also apply to qualified dividends which is what US corporations generally. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

The tax hike would apply to households making more than 1 million. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. According to Section 138202 of the bill the maximum tax rate on these would increase from 20 to 25.

Under the proposed Build Back Better Act the top marginal tax rates will jump from. The main exemption is a relief for a taxpayers main or only home. 3 rows This could result in a significant increase in CGT rates if this recommendation is implemented.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. For sellers of a primary residence there is an exemption before any gains on the. Raising the top capital gains rate for households with more than 1 million in income.

4 rows Proposed capital gains tax Under the proposed Build Back Better Act the top marginal. Were going to get rid of the loopholes that allow Americans who make more. Proposed capital gains tax.

These are realized gains for assets held for at least one year. Another area where the proposed capital gains tax changes could affect ordinary Americans is when selling a home. The proposed changes to Capital Gains Tax CGT explained.

But if you are one of the people who could be subject to capital gains taxes at death you should take note and make a plan. Long-term capital gains tax applies to appreciated assets sold after holding them for at least one year. Proposed Capital Gains Tax Changes.

The top rate would be 288. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. Assets can be acquired in various ways including.

Understanding Capital Gains and the Biden Tax Plan. The proposed capital gains tax reforms of which any Budget. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Many Americans will probably not be affected by Bidens proposed capital asset taxes reform. In particular following a Treasury-commissioned review a major proposed increase in Capital Gains Tax CGT has been attracting headlines in recent weeks. The current capital gains tax system has been in place since 1965 and is most definitely due an overhaul if it is to bear any resemblance to how we live and.

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax Guide Napkin Finance

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

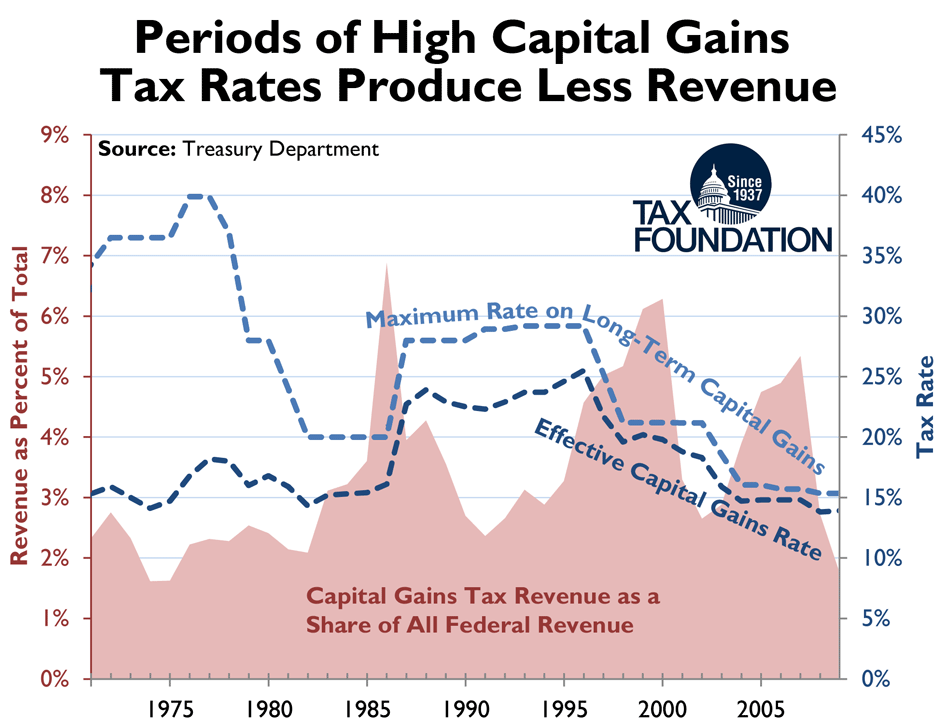

How High Are Capital Gains Taxes In Your State Tax Foundation

Austria Tax Income Taxes In Austria Tax Foundation

Capital Gains Tax Spreadsheet Shares In 2020 Capital Gains Tax Capital Gain Spreadsheet Template

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Reagan Showed It Can Be Done Lower The Top Rate To 28 Percent And Raise More Revenue Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What S In Biden S Capital Gains Tax Plan Smartasset

Can Capital Gains Push Me Into A Higher Tax Bracket

Biden S Better Plan To Tax The Rich Wsj

What You Need To Know About Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)